With solidly invested foundations, SHB is converging all the necessary elements for realizing strategic goals, bringing long-term benefits to customers, shareholders, employees and the community.

The sustainability report is compiled with information and data from the actual activities of SHB and its subsidiaries for the year ended December 31, 2022. The information disclosure is carried out according to Circular 96/2020/TT-BTC.

The person with the highest responsibility related to the sustainable development policy is the CEO. At SHB, policies on environmental and social issues are specified in internal documents issued by the Board of Directors and the CEO. The Board of Management has closely followed the direction and orientation of the Board of Directors, actively implemented activities related to social responsibility and environmental protection in order to bring better values to the community and society.

Economic growth associated with Social Responsibility and Environmental Protection are three factors that play a fundamental role for the sustainable development of SHB. Sustainable development is thoughroutly carried out by SHB from vision, strategic orientation to annual business performance.

7.1. HR policies

SHB has young human resources with an average age ranging from 29 to 31 years old, an age rich in enthusiasm, passion and dedication to development.

With the goal of building an experienced, dedicated and qualified workforce that can meet the requirements of a modern bank, SHB has identified 4 Employee Attraction Values (or Core Values of SHB). 4 values are not only SHB’s competitive advantage in the recruitment market, but also a guideline for the Bank’s human resource development activities to maintain and promote those strengths.

SHB understands and cares about its employees with practical and competitive benefits compared to other banks and businesses in the market. Welfare for female, staff at all levels, and leaders stands out, which is the initial value that attracts talents.

Joining SHB, employees will be able to work in a humane environment that values people, an ideal working environment to dedicate themselves to and develop a sustainable career. SHB understands that the culture of kindness built from “kind people” is the core and sustainable foundation. After all, the human spirit of the new organization is the biggest motivation for employees dedication and attachment for a long time, beyond material values.

With a vision to reach out to the region and internationally, SHB has been cooperating with the world’s leading organizations and brands such as Amazon, Barcelona Club, ManCity Club and many other big brands. SHB is also the first joint stock commercial bank to have an office in ASEAN. Challenge themselves and enroll in big cooperation projects is an opportunity for employees when joining SHB.

Most employees think that “Where to work is not as important as who to work with”. At SHB, employees are proud to be inspired and accompanied by the aspiration to lead of the talented Entrepreneur Do Quang Hien, full of passion and faith in life.

The total number of employees of SHB as of December 31, 2022 was 9,504 people. In 2022, the average income of SHB employees reached VND 22.3 million/person/month, up 1% compared to 2021.

SHB’s human resources in recent years have been continuously enhanced in both quantity and quality to meet the business strategy. SHB is also aiming to build a team of successors, ensuring a source of managers, experts, ... with young average age, well-trained in the field of finance and banking, with comprehensive knowledge of market economy, foreign language proficiency, ability to adapt sensitively to the modern and highly integrated business environment.

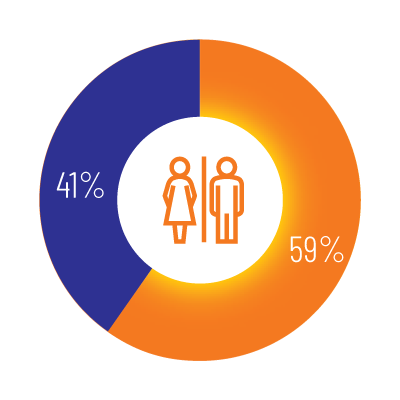

The percentage of female employees at SHB has always been higher than 50% every year. In which, the structure of women in the Board of Management and senior leadership of SHB accounts for 50%, showing that SHB always values women and their important influence on the bank’s business.

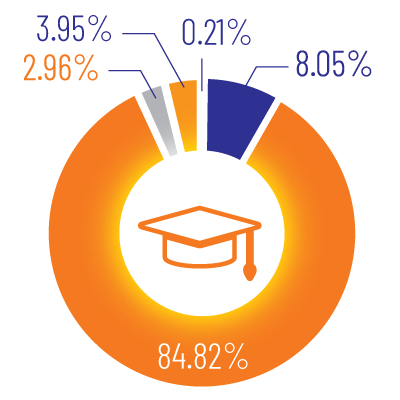

Personnel structure by qualification

PhD

Master

University

College

Intermediate or lower

Personnel structure by seniority

Less than 1 year

From 5 to 10 years

From 1 to 3 years

From 3 to 5 years

More than 10 years

Personnel structure by gender

Male

Female

Personnel structure by age

Gen X

Gen Y

Gen Z

Other

“Living on salary, getting rich on bonus” is the motto that SHB always strives to implement so that employees can feel secure to attach with the bank.

Basically, in 2022, despite being affected by the Covid-19 pandemic, SHB still ensures all policies and benefits of employees.

Salary and bonus regime

In 2022, SHB continued to adjust in the direction of innovation and reclassifying income by title for employees of all business units according to ranking results, grades and regions. KPI sets were continuously revised, aiming to pay a fair and accurate monthly income according to the dedication capacity of employees and the functions and duties of each professional department. The salary policy was associated with the results of job performance evaluation, level of contribution by employees, as well as the business performance by SHB.

Insurance, health care, safety and welfare regimes

Currently, the difference between SHB and other banks is that SHB is paying for employees social insurance, health insurance, unemployment insurance, personal income tax and trade union fee. This is one of the prominent policies that not only helps to ensure and improve income for employees, but also is one of the policies to attract employees to work at the bank.

In addition to implementing policies for employees in accordance with the law, SHB also applies many useful welfare programs for employees every year such as: allocation of working uniforms, sufficient provision of modern working tools in accordance with professional operation; organization of annual vacation for all employees; policies to give employees preferential loans to buy houses, cars, consumer loans with low interest rates, etc.

Always consider human resources as the bank’s most valuable asset, maximizing human resources, taking people as the center of the bank’s development motivation.

Human resources development is one of the four strategic pillars of SHB. SHB created all conditions for each individual employee to develop his career, focusing on training high-quality human resources with training plans built on the bank’s business development strategy, according to analysis of financial market development trends, based on annual employee need survey. With the policy that all employees have the opportunity to be trained and developed, so all training costs organized by SHB as well as training courses sent by SHB are sponsored by the bank.

In 2022, SHB continued to foster and develop employees’ capacity through 05 groups of training programs with 86 courses. In particular, SHB organized the first Talent Lead course excellent senior management staff. SHB’s first Talent Lead participants are trusted to bring about breakthrough – blooming and realizing the goal of becoming No.1.

Total training hours in 2022 of all employees of the Bank were 166,006 hours, equivalent to the average number of training hours/one employee at SHB of 29.2 hours/employee/year.

| Object | Hours of training (hours x person) | Average training hours/year (hours/person/year) |

|---|---|---|

| Staff | 138,328 | 29.9 |

| Management | 27,678 | 25.7 |

| Total | 166,006 | 29.2 |

7.2. Responsibility to the local community

Over the years, SHB has always been known as one among high performance commercial banks, affirming its prestige and brand name domestically and internationally. Along with sound business activities, SHB has also actively demonstrated community responsibilities with a series of practical and meaningful social security programs.

In 2022, SHB has spent nearly VND 80 billion budget for sponsorship activities towards the social community, including socio-cultural sponsorship activities, cultural and spiritual works, supporting the poor, difficult situations and the development of the young generation.

Previously, in 2021, when the Covid-19 pandemic was complicated, all socio-economic activities were stalled, people’s lives were seriously affected, in order to share difficulties with the community, SHB spent hundreds of billions of VND on social security activities, increasing 6 times over the same period of the previous year.

With contributions to the development of the country, SHB was honored to be awarded the Certificate of Merit by the Prime Minister in accompanying the Government to remove difficulties for businesses and implement social security during the pandemic; the Bank was also honored by Asiamoney Magazine as “The best socially responsible bank in Vietnam”, “Best CSR Bank” honored by the International Data Group (IDG) in collaboration with the Vietnam Banks Association; “Bank with the best COVID pandemic management initiative in Vietnam” honored by The Asian Banking and Finance (ABF) magazine, along with many other prestigious domestic and foreign awards. It is a testament to the community’s trust and recognition for a bank that always takes “social responsibility” as its business philosophy, creating long-term brand value.

7.3. Environmental impact assessment report

SHB has long been aware of the responsibility of a Top commercial bank in Vietnam in terms of scale to make every effort to minimize the impact on the environment and contribute to the regeneration and preservation of the green planet. SHB has determined a sustainable development strategy that not only brings effective and safe financial growth to the bank itself, but also rationally exploits and economically uses natural resources, protects and improves the quality of the living environment.

At SHB, the policy on environmental issues is concretized in the regulations issued by the Board of Directors and the CEO. In which, the CEO is responsible for implementing policies. The CEO and the Board of Management closely followed the direction and orientation of the Board of Directors, actively implemented activities related to social responsibility and environmental protection in order to bring better values to the community and society.

As a service provider in the financial and banking sectors, SHB’s business activities do not produce much greenhouse gas emissions and do not place a significant impact on the environment. The sources of greenhouse gas emissions, if any, mainly come directly from the use of work tools and equipment, and indirectly from lighting activities in buildings, repair and maintenance of equipment, power generation, air conditioning system, as well as the means of transportation of employees and customers around the transaction points.

In order to create a green space, SHB alternately arranged bonsai at buildings and transaction points, helping to reduce the amount of CO2 emitted into the air. In addition, customer transactions, internal transactions, training,... in online form also help reduce emissions during transportation and save energy.

SHB is a service provider in the fields of finance and banking, so the main materials for the business process are mainly printing paper, printing ink, stationery, etc.

SHB’s total annual cost of using materials increases in line with the size of the bank’s business. However, thanks to effective saving measures, the cost of using materials per staff is always kept at a low level. The cost of materials in 2022 was VND 1.18 million/01 employee/year, a decrease of 13.2% compared to 2021.

Energy used for business activities at SHB is mainly electricity for lighting and maintaining computer operation, air conditioning, fuel for staff transportation vehicles, etc.

Facing negative impacts from climate change affecting not only the present but also future generations, SHB always focused on monitoring the use of energy and natural resources, thereby contributing to minimizing greenhouse gas emissions intensity and environmental impacts.

SHB used water mainly for the activities of all staff and the building such as drinking water, sanitation, floor cleaning, labor tools, etc. and water cost was included in the building rental cost. Domestic wastewater was brought to a gathering place for treatment according to the building’s regulations.

Cost of drinking water for managers, staff and guest reception was paid by SHB with the highest saving spirit such as pouring enough water for drinking, using small water bottles in internal meetings. For meetings and receptions with guests, the bank provided small volume water bottles to avoid wasting.

The source of waste potentially harmful to the environment at SHB was mainly solid waste generated from office activities such as unusable printing paper, cardboard, stationery that are no longer usable, etc. and the source of gas waste mainly came from vehicles entering, leaving, circulating through the building. Therefore, SHB arranged personnel in charge of the environment and implemented environmental protection plans.

- The environmental sanitation outside the working area was done by the outsourced environmental company (included in the cost of building renting)

- The cleaning inside working rooms were done by the administrative department of the bank

- Modern information techniques such as videoconference, telephone were maximized to organize internal meetings, interview staff across the country to minimize travel time as well as frequency of using aircraft, vehicles, contributing to reducing CO2 emissions into the environment.

- In addition, each bank employee always upheld the spirit of keeping clean and cleaning his own working desk and the surrounding area; Strengthen exchange of documents and official letters via internal email to minimize the amount of redundant printed paper; reuse old stationery.

With the intention of strictly complying with the law on environmental protection, during the operation, SHB was not sanctioned for any violation related to environmental issues.

Hanh Phuc Rice Factory - Typical project loaned by SHB using capital funded by the World Bank