VIETCOMBANK PROFILE

Being proud

of culture and tradition

Vietcombank profile

CHARTER CAPITAL

VND 47,325 billion

GENERAL INFORMATION

TRADING NAME

-

Name in Vietnamese:NGÂN HÀNG THƯƠNG MẠI CỔ PHẦN NGOẠI THƯƠNG VIỆT NAM

-

Name in English:JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM

-

Trading name:VIETCOMBANK

-

Abbreviation name:VIETCOMBANK

- License of Establishment and Operation No. 138/GP-NHNN issued by State Bank of Vietnam, dated May 23rd, 2008.

CERTIFICATE OF BUSINESS REGISTRATION

-

Tax code:0100112437

- Certificate of Business Registration No.0103024468 issued by Ha Noi Department of Planning and Investment dated June 2nd, 2008 (first registration) 15th Amendment issued on April 14th, 2022

CHARTER CAPITAL (OWNER’S EQUITY)

-

VND 47,325,165,710,000

-

In word:Forty-seven thousand three hundred and twenty-five billion, one hundred and six fifty-five million, seven hundred and ten thousand VND

TICKER SYMBOL: VCB

-

Par value:VND 10.000

-

Number of shares:4,732,516,571

-

Address:No. 198 Tran Quang Khai Str., Ly Thai To Ward, Hoan Kiem Dist., Ha Noi, Vietnam

-

Phone number:84-24-3934 3137

-

Fax:84-24-3826 9067

-

Website:www.vietcombank.com.vn

ESTABLISHMENT AND DEVELOPMENT HISTORY

January 20th 1955

Establishing Foreign Exchange Bureau under National Bank of Vietnam – predecessor of Vietcombank.

April 1st 1963

Officially put into operation (According to Decree No 115/CP dated October 30th 1962 of the Government).

April 1965 – April 1975

Directly engaged in the money trail (codename B29) to receive money abroad, controlled, managed and supplied to Southern Revolution.

April 1975 – 1987

Took over the old banking system, inherited Vietnam’s membership in international financial organizations; participated in settlement of national debt and anti-embargo movement; successfully assumed the role of unique bank holding dominant position in 3 aspects of foreign currency, export - import credit and international transactions and payment.

1987

As the only commercial bank allowed to issue Vietnamese dong banknotes with foreign origin, contributing to synchronous management of use and spending of foreign currency.

2000-2005

Pioneered building and successfully implemented Banking Restructuring and Modernization Project.

June 2nd 2008

Officially transformed into joint-stock commercial bank after pioneering equitization and successful getting an IPO in 2007.

June 30th 2009

VCB was officially listed on Ho Chi Minh City Stock Exchange (HOSE).

September 30th 2011

Signed a strategic shareholder agreement with Mizuho Corporate Bank under Mizuho Financial Group, Japan.

March 31st 2013

Launched a new brand identity system and slogan “Together for the future”.

December 01st 2016

Issued Vietcombank’s development strategy till 2020. Vietcombank regained its No 1 position in profit in 2016.

October 19th 2018

Set up Vietcombank’s presence in Laos.

November 28th 2018

Became the first bank approved by State Bank of Vietnam according to Decision No 2315/QĐ-NHNN on application of Basel II according to Circular No 41 dated January 01st 2019, one year earlier than compliance deadline.

November 1st 2019

Launched its representative office in the US.

November 12th 2019

Inked insurance distribution deal with FWD Group with the largest value in life insurance up to time of signing.

2019

Become Vietnam’s first bank reaching USD 1 billion in profit.

January 27th 2020

Successfully launched core banking system

2020 up to now

Remain steadfast against Covid-19 pandemic, Vietcombank affirms its position as No 1 bank in Vietnam in some aspects, world’s top 100 largest public banks in market capitalization, according to Reuters.

- Maintaining the position as the No. 1 bank in Vietnam.

- To become one of 200 largest banking and financial corporations in the world.

- One of 700 global largest public companies.

- And to contribute significantly to the development of Vietnam.

SERVICES AND BRANCH NETWORK COVERAGE

SERVICES AND BUSINESS SECTOR

-

Deposits;

-

Loans;

-

Discounting, re-discounting of bills and other valuable papers;

-

Guarantees;

-

Domestic and foreign factoring;

-

Credit cards;

-

Other forms of credit grant in accordance with legal regulations;

-

Settlement and banknotes;

-

Foreign exchange in domestic and international markets in accordance with relevant regulations;

-

Correspondent banking;

-

Commodity price derivatives within the scope prescribed by the State Bank of Vietnam;

-

Other services as per the bank’s Business Registration.

BRANCH NETWORK COVERAGE

510

TRANSACTION OFFICES

121

BRANCHES

58/63

PROVINCES AND CITIES

1.163

CORRESPONDENT BANKS

As at December 31st, 2022, Vietcombank has 121 Branches with 510 transaction offices operating in 58/63 provinces and cities across the country:

- 15 branches in Hanoi (12.4%);

- 19 branches in the Red River Delta Region (15.7%);

- 9 branches in Northern Midland and Mountainous Region (7.4%);

- 16 branches in Northern and Central Regions (13.2%);

- 14 branches in the Southern-Central and Highland Regions (11.6%);

- 18 branches in Ho Chi Minh City (14.9%);

- 16 branches in the Western-Southern Region (13.2%);

- 14 branches in Eastern-Southern Region (11.6%).

As at December 31st, 2022, Vietcombank maintains correspondent relationships of 1,163 correspondent banks in 93 countries and territories worldwide.

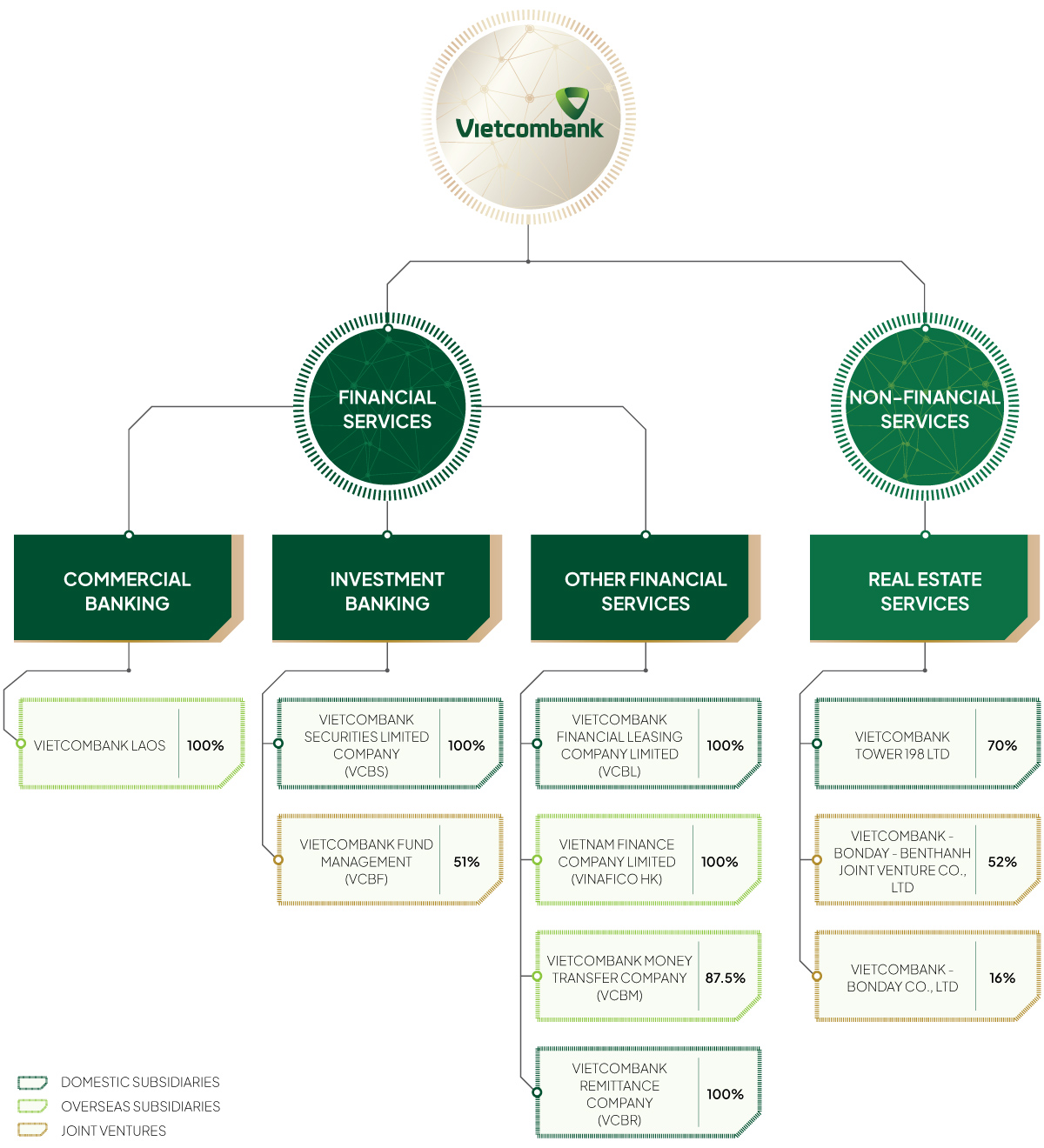

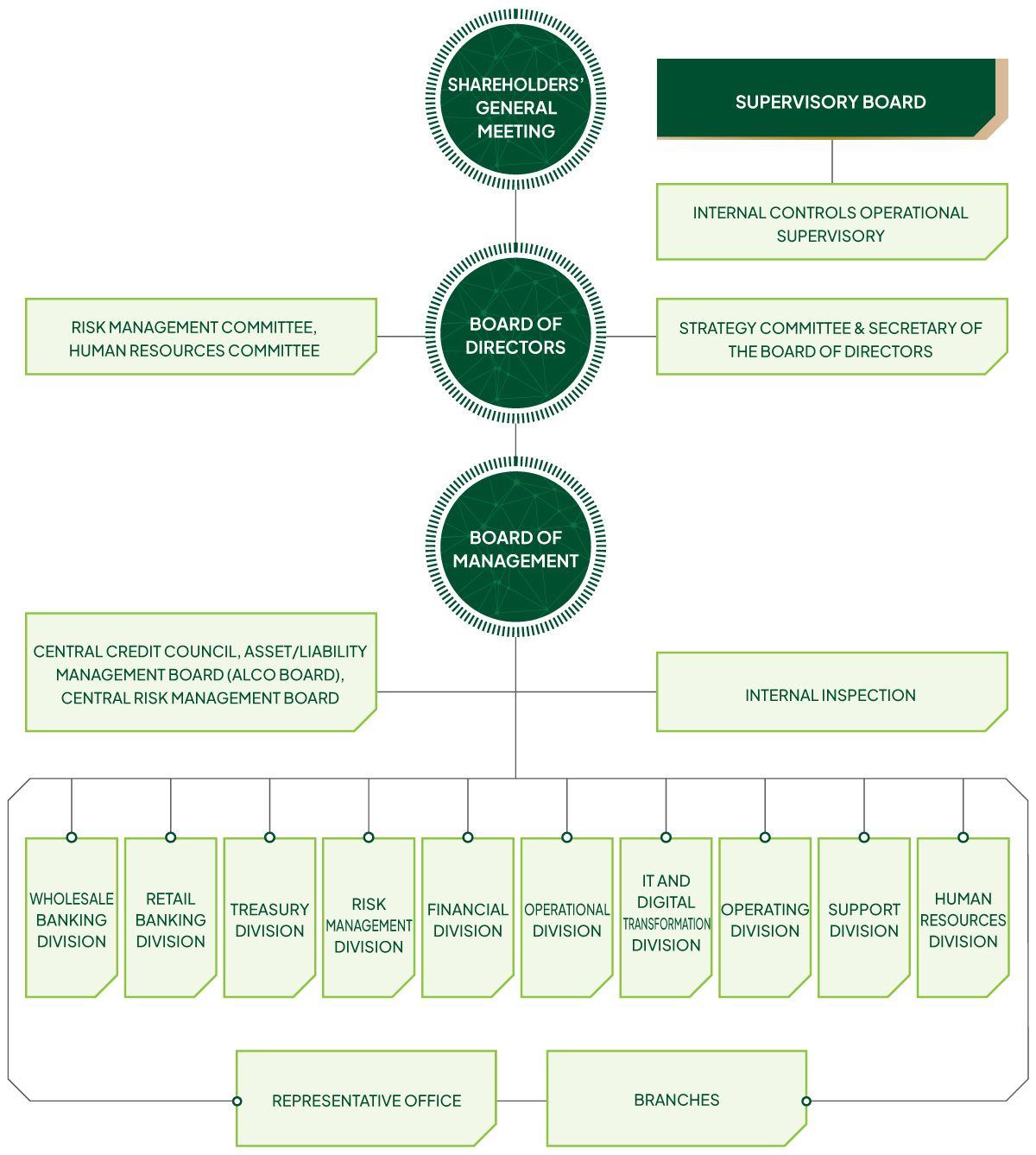

Model of governance

Management Structure

OUR STRATEGY

Vision and mission towards 2025

-

No. 1 Bank

in Vietnam -

One of the 100 largest banks in Asia

-

One of the 300 world’s largest financial and banking corporations

-

One of the 1,000 world’s largest listed companies

-

Contributing to the development of Vietnam

Strategic objectives towards 2025

-

1

No 1 in profitable scale with diverse income structure shifting toward increase of proportion of non-credit income.

-

2

Take the lead in digital transformation in the banking industry.

-

3

Most effective bank in risk management.

-

4

No. 1 bank in quality of human resources.

-

5

Take the lead in environmental, social and corporate governance (ESG).

-

6

Do research on listing shares on international stock market.

-

1

No 1 in profitable scale with diverse income structure shifting toward increase of proportion of non-credit income.

-

2

Take the lead in digital transformation in the banking industry.

-

3

Most effective bank in risk management.

-

4

No. 1 bank in quality of human resources.

-

5

Take the lead in environmental, social and corporate governance (ESG).

-

6

Do research on listing shares on international stock market.

Sustainable development goals

Implementation of sustainable development goals, Vietcombank focuses on completing 5 pillars based sustainable development roadmap.

- Continuously enhance financial capacity to drive stable and sustainable development, ensure interests of customers, shareholders and partners.

- Complete environmental, social and corporate risk management system.

- Ensure participation of stakeholders in sustainable development process.

- Implement international standards (GRI, TCFD) on sustainable development.

- Conduct research and construction of modern, sustainable banking products and services.

Orientation of business operation in 2023

-

1Implement the Digital Transformation Action Program and the Transformation Action Plan on the approved schedule, ensuring quality.

-

2Improve quality of human resource, especially human resource for digital transformation.Developing digital culture and applying Agile working methods.

-

3Innovate growth model in association with operational restructuring, uphold overall strength of the whole system of VCB.

-

4Promote customer and product development.

-

5Complete policies and mechanisms.

-

6Implement on schedule with highest determination, promote compulsory transfer of weak credit institutions.

-

1Promote credit growth in association with effective and sustainable business restructuring scheme: increasing proportion and quality of collateral in total outstanding loans; promote sales credit growth in association with customer and service development; promote retail credit growth, credit in transaction offices and ensure credit quality.

-

2Improve proportion of non-credit income with a focus on service income. Expand the supply of products and services on digital channels and improve quality of service as well as customer experience.

-

3Promote capital structure toward higher efficiency and ensure sustainable development, upgrade VCB’s market position.

Some key

indicators

TOTAL ASSETS

increased by 9%

compared to 2022

DEPOSITS OF FIRST MARKET

Growth in line with credit growth LDR not higher than that of 2022

CREDIT

increased by 14%

compared to 2022

BAD DEBT RATIO

< 1,5 %

PROFIT BEFORE TAX

min growth of 15%

as of 2022

-

1

Scale up capital mobilization appropriate with capital use, closely follow up market developments, capital restructuring toward effectiveness and sustainability.

-

2

Scale up capital mobilization in accordance with orientation of the State Bank of Vietnam; strengthen restructuring of credit portfolio to ensure safety and effectiveness; control quality of credit, manage debt restructuring and step-up bad debt resolutions and provisions of credit losses.

-

3

Strengthen monitoring of operational risk, focus on supervision and inspection; enhance infrastructure capacity to meet business demands; ensure IT safety, security and confidentiality.

-

4

Maintain, strengthen and improve service-based income; increase proportion of service revenue in total business revenue.

-

5

Effectively and timely implement action plan on digital transformation and push up the journey to Agile transformation; develop product, service closely attached with improvement of IT, data analysis and digitalization capability.

-

6

To continue enhancing the organization’s overall structure, to expand the network, and to raise the bar for human resource training quality; Focus on procurement of headquarters for new branches and branches that lack fixed head office; implement social security activities to share difficulties with community, mitigate Covid-19 pandemic’s impacts and natural disasters, prioritized areas such as education, health.

-

7

Implement the roadmap for environmental, governance, social practices at Vietcombank based on criteria of VNSI sustainable development, improve sustainable development at Vietcombank based on criteria of sustainable development report-GRI, TCFD and build a comprehensive sustainable development strategy for Vietcombank in the coming time.

06 đột phá chiến lược

-

1Triển khai Chương trình hành động chuyển đổi số và Kế hoạch hành động chuyển đổi đúng tiến độ đã phê duyệt, đảm bảo chất lượng.

-

2Nâng cao chất lượng nguồn nhân lực, trong đó chú trọng nguồn nhân lực thích ứng cho chuyển đổi số. Phát triển văn hóa số và ứng dụng phương pháp làm việc Agile.

-

3Đổi mới mô hình tăng trưởng gắn với chuyển dịch cơ cấu hoạt động; phát huy thế mạnh tổng thể của toàn hệ thống VCB.

-

4Đẩy mạnh công tác phát triển khách hàng, phát triển sản phẩm.

-

5Hoàn thiện hệ thống cơ chế, chính sách.

-

6Triển khai đúng tiến độ với tinh thần quyết tâm cao nhất Phương án nhận chuyển giao bắt buộc một tổ chức tín dụng yếu kém.

03 trọng tâm trong chuyển dịch cơ cấu hoạt động kinh doanh

-

1Tăng trưởng tín dụng gắn với chuyển dịch cơ cấu tín dụng hiệu quả bền vững: Gia tăng tỷ trọng và chất lượng tài sản đảm bảo trong tổng dư nợ; Tăng trưởng tín dụng bán buôn gắn với phát triển khách hàng và dịch vụ; Tăng trưởng tín dụng bán lẻ, tín dụng tại phòng giao dịch đồng thời với việc đảm bảo chất lượng tín dụng.

-

2Phấn đấu cải thiện tỷ trọng thu nhập phi tín dụng, trọng tâm là thu nhập từ dịch vụ. Mở rộng cung ứng các sản phẩm dịch vụ trên kênh số và nâng cao chất lượng dịch vụ, trải nghiệm của khách hàng.

-

3Cơ cấu danh mục nguồn vốn theo hướng gia tăng hiệu quả và đảm bảo phát triển bền vững. Phát triển mạnh mẽ vị thế tạo lập thị trường của VCB.

Một số

chỉ tiêu chính

TỔNG TÀI SẢN

Tăng 9%

so với năm 2022

HUY ĐỘNG VỐN TT1

Tăng trưởng phù hợp với tăng trưởng tín dụng LDR không cao hơn mức thực hiện năm 2022

TÍN DỤNG

Tăng 13%

so với năm 2022

TỶ LỆ NỢ XẤU

< 1,5 %

LỢI NHUẬN TRƯỚC THUẾ

Tăng tối thiểu 15%

so với năm 2022

Các giải pháp chủ đạo

-

1

Tăng trưởng huy động vốn phù hợp với sử dụng vốn, bám sát diễn biến thị trường, cơ cấu nguồn vốn theo hướng hiệu quả bền vững.

-

2

Tăng trưởng tín dụng theo đúng định hướng củva NHNN; Cơ cấu lại danh mục tín dụng đảm bảo an toàn, hiệu quả; Tăng cường kiểm soát chất lượng tín dụng, quản lý các khoản nợ đang được cơ cấu lại và đẩy nhanh tiến độ thu hồi nợ xấu, nợ đã xử lý dự phòng rủi ro.

-

3

Tăng cường kiểm soát rủi ro hoạt động, chú trọng công tác kiểm tra, giám sát; Tăng cường năng lực cơ sở hạ tầng đáp ứng yêu cầu kinh doanh; Tăng cường đảm bảo an toàn, an ninh, bảo mật cho hệ thống công nghệ thông tin.

-

4

Duy trì, đẩy mạnh và cải thiện thu nhập từ hoạt động dịch vụ; Phấn đấu gia tăng tỷ trọng thu dịch vụ trong tổng thu nhập hoạt động kinh doanh.

-

5

Triển khai có hiệu quả, chất lượng, đúng tiến độ Chương trình hành động chuyển đổi số và Kế hoạch hành động chuyển đổi; Chuyển đổi mô hình tổ chức theo Agile; Phát triển sản phẩm, dịch vụ số gắn với nâng cao các năng lực về công nghệ, năng lực phân tích dữ liệu và năng lực số hóa.

-

6

Tiếp tục kiện toàn bộ máy tổ chức, phát triển mạng lưới và nâng cao chất lượng đào tạo nguồn nhân lực; Chú trọng triển khai việc mua sắm trụ sở cho các Chi nhánh mới và các Chi nhánh chưa có trụ sở ổn định; Tiếp tục triển khai, thực hiện công tác an sinh xã hội nhằm chia sẻ khó khăn với cộng đồng, hỗ trợ khắc phục giảm nhẹ các hậu quả do dịch Covid-19 và thiên tai, ưu tiên các lĩnh vực giáo dục, y tế.

-

7

Triển khai lộ trình cải thiện thực hành về Môi trường, Quản trị, Xã hội tại Vietcombank theo các tiêu chỉ của bộ chỉ số phát triển bền vững VNSI, từng bước cải thiện hoạt động phát triển bền vững tại Vietcombank theo bộ tiêu chuẩn báo cáo phát triển bền vững GRI, TCFD và xây dựng chiến lược phát triển bền vững toàn diện cho Vietcombank trong thời gian tới.

Vietcombank Award 2022

DOMESTIC AWARDS

1

VCB Digibank’s digital banking service won the Sao Khue award 2022

Awarding body:

VINASA

On April 23rd 2022, The Vietnam Software and Information Technology Services Association (VINASA) held a ceremony, to announce and award the 2022 Sao Khue Award. Vietcombank’s VCB DigiBiz Digital Banking Service was highly commended by the jury and recognized during the ceremony announcing and presenting the 2022 Sao Khue Award. VCB DigiBiz is a digital banking channel with the aim to meet demands of financial transactions at anytime, anywhere via App VCB DigiBiz on App markets or Vietcombank’s website. Simply, what customers need is a username, password to use this service on a diverse platform with a unified transaction limit. With modern interface, VCB DigiBiz brings new and simple experience to customers..

2

TAKE THE LEAD IN TOP 10 MOST PRESTIGIOUS COMMERCIAL BANKS IN 7th CONSECUTIVE YEAR

Awarding body:

VIETNAM REPORT

Vietcombank was honored on top of 10 prestigious commercial banks in 2022 and top 10 prestigious and effective public enterprises. Accordingly, Vietnam Report has coordinated with Vietnamnet to organize the announcement ceremony of Top 50 most prestigious and effective public companies, Top 10 prestigious bankers-Insurance & IT companies 2022. Vietcombank continued to take the lead of Top 10 most prestigious commercial banks 2022 and Top 10 most prestigious and effective public companies. The year 2022 is the 7th consecutive year Vietcombank takes the lead on Top 10 most prestigious commercial banks. The award is based on research and independent evaluation of Vietnam Report to honor effective, experienced and well-position banks that make positive contributions to common development of banking industry and make ceaseless efforts in building impressive banking brands for customers, consumers and partners.

3

Vietcombank has been named to the top 10 strongest brands in Vietnam in the 9th consecutive year

Awarding body:

VIETNAM

ECONOMIC TIMES

On October 12th, 2022, the Vietnam Economic Review hosted a ceremony to recognize and celebrate Vietnam’s Top 10 strongest brands. Vietcombank has been named to the top 10 strongest brands in Vietnam in the 9th consecutive year.

Vietnam is embracing “the green in national branding”, Vietnam strong brand program 2022 has surveyed, evaluated, announced and honored corporate brands with outstanding business and production, service performance. The evaluation criteria in 2022 focuses on strategy, action plans and business performance in the process of: digital transformation, green transformation, energy efficiency, clean energy, innovative production models, inclusive business and humanity; brand protection, employees and community-based policies, indicators of business recovery and growth after Covid-19 pandemic’s serious impacts.

4

Vietcombank ranked first of top 10 Vietnam best profitable commercial banks

Awarding body:

VIETNAM REPORT

On November 25th, 2022, in Hanoi, Vietnam Report Joint Stock Company (Vietnam Report) and the e-newspaper Vietnamnet co-hosted a ceremony to recognize the top 500 profit-making enterprises in Vietnam in 2022.

Vietcombank was honored Top 50 Vietnam Best profitable enterprises 2022, ranked first of top 10 Vietnam best profitable commercial banks. According to Vietnam Report, the statistics in the last 5 years show that average Compound Annual Growth Rate (CAGR) of all enterprises in PROFIT500 is 10.12%, in which, financial sector reached 17.3%. Growth outlook of financial sector is very positive and make positive contributions to Vietnam’s economic recovery in the coming time.

5

VIETCOMBANK NAMED AS VIETNAM NATIONAL BRAND IN THE 8th CONSECUTIVE YEAR

Awarding body:

VIETNAM TRADE PROMOTION AGENCY – MINISTRY OF INDUSTRY AND TRADE

On the evening of November 02nd 2022, at National Convention Center, Hanoi, Vietnam Trade Promotion Agency – Ministry of Industry and Trade announced the 8th Vietnam national brand award. Vietcombank won the award for the 8th consecutive year thanked to operational efficiency, stability, superior asset quality, diverse and prestigious services in banking industry. With an action motto of “Transformation-Efficiency-Sustainability” and the concept of operation of “Responsible-Drastic-Creative”, Vietcombank has strived and achieved positive business performance, well-developed business scale, closely controlled credit quality, business scheduling. Vietcombank has proactively implemented socio-economic recovery program of the Government, especially interest rate supporting policy from State budget for trade loans, cooperatives, business households in 2022-2023 period and other support solutions of the banking sector. These aim to remove difficulties for people and enterprises being hit by the pandemic and continuously improving quality of product and services to better meet customers’ demands.

6

VIETCOMBANK NAMED AS “TYPICAL ENTERPRISE FOR EMPLOYEES” FOR 3rd CONSECUTIVE YEAR

Awarding body:

VIETNAM GENERAL CONFEDERATION OF LABOR

Hanoi, November 16th 2022, Vietnam General Confederation of Labor coordinated with Ministry of Labor, War Invalids and Social Affairs, Vietnam Chamber of Commerce and Industry (VCCI) to organize a ceremony to honor “Typical enterprises for employees” 2022. Vietcombank was honored as “Typical enterprise for employees” for the 3rd consecutive year.

Mr. Hong Quang – member of the Board of Directors cum Head of Human Resources Division, Chairman of Vietcombank’s Trade Union said: “The ‘Typical enterprise for employees’ award” will surely improve position of Vietcombank’s employees, affirm responsibility and commitment of the Party Committee, Board of Directors, Executive Board of Vietcombank’s Trade Union to taking care, ensuring and improving employees’ benefits. We believe that the award is of great significance to raise awareness of employers, trade unions as well as the whole society on human factor as the most precious resource. The award encourages Vietcombank and business community to better take care of employees, implement policies of the Party and the State, make contributions to social security, create motivation for economic development”.

7

VIETCOMBANK NAMES AS THE BEST BANK 2022 at NAPAS Member Banking Conference 2022

Awarding body:

NAPAS

Da Nang, October 18th 2022, on the framework of NAPAS Member Banking Conference 2022, Vietcombank was honored with 3 big awards including: Best Bank 2022 award, dynamic bank in credit card transaction 2022, Leadership in transactions via VietQR code. These awards are achieved Vietcombank’s positive results in ceaselessly investing, developing and innovating its products and services, improving quality of service in 2022. Vietcombank is considered as a pioneer in the banking industry to accelerate development of E-payment, diversify non-cash payment forms in accordance with orientations of the Government and State Bank of Vietnam.

8

VIETCOMBANK HONORED TOP 10 BEST WORKPLACE IN VIETNAM 2022 AND TOP 500 LEADING EMPLOYERS IN VIETNAM

Awarding body:

VIET RESEARCH AND INVESTMENT NEWSPAPERS

On December 21st 2022, at Vietnam National Convention Centre – Hanoi, Viet Research coordinated with Investment Newspaper to announce Top 50 Vietnam Leading Employers and Top 10 Vietnam Best workplace in 2022 accompanied by Personnel Talk themed “Building a good workplace- Key to sustainable development”, Vietcombank was ranked 1st of Top 10 Best workplace in banking sector and 3rd of Top 500 leading employers in Vietnam (VBE500). According to organizer, the survey results in 2022 represent the uniformity, efficiency and sustainability in executive management, human resource development as well as building a happy working environment of Vietcombank. The results also reveal Vietcombank’s efforts in developing corporate culture and a strong employer brand; building and maintaining best workplace with good wage and welfare policies for employees.

INTERNATIONAL AWARDS

1

VIETCOMBANK HONORED 3 BIG AWARDS BY THE ASIAN BANKER

Awarding body:

THE ASIAN BANKER

Hanoi, March 24th 2022, Vietcombank received 3 big awards of The Asian Banker including:

- Best Digital Banking service in Vietnam.

- Most Helpful Bank during Covid-19.

- Most Selected Main Retail Bank in Vietnam.

With a history of more than 20 years, The Asian Banker is one of the leading organizations in evaluating and rating global financial institutions. On a yearly basis, The Asian Banker organizes many award categories related to important activities including: trade finance, money management, payment, etc. The council of advisors of The Asian Banker including experts from credit institutions, banks and global asset management companies, have conducted rigorous review and evaluation of profiles of financial institutions.

2

THE ONLY REPRESENTATIVE OF VIETNAM ON TOP 1,000 WORLD’ LARGEST PUBLIC ENTERPRISES BY FORBES

Awarding body:

FORBES

According to the ratings of “The World’s Largest Public Companies 2020” by Forbes, Vietcombank is Vietnam’s only representative to be on Top 1,000 World’s largest public companies. Since 2015, Vietcombank’s rank has been significantly upgraded to 950 from 1,985 and Top 1,000 World’s largest public companies by Forbes. Vietcombank is Vietnam’s leading bank with total asset over VND 1.8 quadrillion and the largest capitalization value among public credit institutions in Vietnam stock market. Vietcombank has now 22,599 employees, a nationwide operating network including headquarter in Hanoi and more than 600 branches, transaction offices nationwide.

Since 2015, Vietcombank’s rank has been significantly upgraded to 950 from 1,985 and Top 1,000 World’s largest public companies by Forbes.

3

VIETCOMBANK NAMED AS VIETNAM STRONGEST BANK IN THE 6th CONSECUTIVE YEAR BY THE ASIAN BANKER

Awarding body:

THE ASIAN BANKER

Recently, The Asian Banker has named Vietcombank as Vietnam Strongest bank in 2021. This is the 6th consecutive year Vietcombank receives this prestigious award. This award has a long tradition, launched in 2007 based on the balance sheet, reviewed and approved by a detailed and transparent selection process to recognize performances of commercial banks

This prestigious award is used by investors, financial experts and media agencies referring to financial strength of banks in the region, a useful information source for banks, international firms, potential partners of banks. In 2021, with 3.59/5 scores, Vietcombank took the lead among groups of banks in Vietnam.

4

S&P RATINGS RAISES VIETCOMBANK’S CREDIT RATINGS TO THE HIGHEST LEVEL AMONG BANKS IN VIETNAM

Awarding body:

S&P RATINGS

On May 26th 2022, S&P Ratings (S&P) upgraded Vietnam’s national credit rating to BB+ from BB. A day later, S & P announced to update Vietcombank’s credit rating (The only bank in Vietnam is upgraded its credit rating). As No 1 bank in Vietnam with an important position, Vietcombank is assessed to be beneficiary from external resources when Vietnam’s national credit rating is higher and possibility of receiving timely and full support from the Government in case of financial difficulties.

S&P Ratings (S&P) upgraded Vietnam’s national credit rating to BB+ from BB. A day later, S & P announced to update Vietcombank’s credit rating.

5

VIETCOMBANK HONORED 02 PRESTIGIOUS INTERNATIONAL AWARDS BY INTERNATIONAL FINANCE MAGAZINE

Awarding body:

INTERNATIONAL

FINANCE MAGAZINE

Vietcombank has recently honored 02 awards by International Finance Magazine (IFM) including: “Vietnam Best Investment bank in 2021” and “Vietnam Best digital transformation in banking”. The results are evaluated and reviewed by Council of Advisors of IFM based on Vietcombank’s operating results in 2021. These results are evaluated and reviewed by the Council of Advisors of IFM based on business performance of Vietcombank in 2021. IFM recognized Vietcombank’s efforts in developing and innovating quality of digital technology applications to bring optimal experience to customers. Accordingly, all finance related requirements including e-Account opening, credit card, savings account, payment account, mobile payment, QR code payment, etc. can be made easily, quickly and conveniently via VCB Digibank.

These awards are motivation and goals for Vietcombank to continue striving for marking its name in the financial market domestically and internationally in the coming time.

6

VIETCOMBANK HONORED 4 AWARDS BY JCB

Awarding body:

JCB

At the JCB Annual Meeting 2022 on August 03rd 2022 held in Da Nang, Vietcombank was honored 04 important award categories by JCB:

- Leading Licensee in credit card retail spending volume 2021.

- .Leading Licensee in Merchant Sales 2021.

- Leading Licensee in New products and solution 2021.

- Leading Licensee in EC merchant sales 2021.

Previously, Vietcombank received many important awards from many prestigious organizations including “Typical bank 2021” by NAPAS in domestic payment, Leadership in Payment Volume 2022, Leadership in Merchant Sales Volume and Leadership in Commercial Payment Volume by VISA.

These awards once again affirm Vietcombank’s leading prestige, brand in card payment services in Vietnam. It is also a clear proof for Vietcombank’s ceaseless efforts in developing, innovating products, building trust with customers who have been using Vietcombank’s card products.

7

LEADERSHIP IN TOP 25 VIETNAM LEADING FINANCIAL BRANDS

Awarding body:

FORBES VIETNAM

At the Brand Conference 2022 dated October 27th 2022, Vietcombank continued to rank 1st of “Top 25 leading financial brand 2021” by Forbes Vietnam with brand value of USD 705 million. Vietcombank continues to be on Top of Forbes Vietnam’s rankings and Forbes Global 2000. This represents stable and effective business performance, asset quality and most diversified service income in the banking industry, good business growth, closely controlled credit quality, business scheduling.

8

VIETCOMBANK HONORED IMPORTANT AWARDS FOR CARD PRODUCTS

Awarding body:

VISA

In the framework of annual VISA award, Vietcombank has been honored 4 important award categories of Leadership in Payment Volume, Leadership in Debit Payment Volume, Leadership in Merchant Sales Volume, Leadership in Commercial Payment Volume Growth. These awards affirm Vietcombank’s leading prestige and brand in card payment volume in Vietnam. In addition, it is a clear proof for ceaseless efforts of Vietcombank in product development and improvement in the past year, it also represents customer trust for Vietcombank’s card products.

9

VIETCOMBANK WIN REFINITIV VIETNAM FX AWARD AS THE BEST FXALL TAKER

Awarding body:

REFINITIV UNDER LONDON STOCK EXCHANGE GROUP

At the awarding ceremony of Refinitiv Vietnam FX Award 2022 organized by Refinitiv under London Stock Exchange Group dated March 24th 2022 at headquarter of Vietcombank, 198 Tran Quang Khai, Hoan Kiem, Hanoi, Vietcombank was honored Best Fxall Taker Award – Most volume traded in 2021.

The award is based on statistics of Refinitiv under London Stock Exchange Group on transactions of foreign exchange trading of members of Refinitiv Fxall in 2021. This is an official foreign exchange trading platform of Refinitiv in Vietnam to cover all major currency pairs/foreign currency in international markets under form of automatic price matching. According to Mrs. Tran Ngoc Nga, - Business Manager of Refinitiv, Vietnam and Myanmar, the foreign exchange award is a long-lasting and prestigious one in the Asia Pacific region of Refinitiv. In Vietnam, the award is organized the 2nd time in 2022 and based on transparency.

10

VIETCOMBANK HONORED WITH ITEMS OF IMPORTANT AWARD OF VISA INC

Awarding body:

VISA

On October 28th 2022, Vietcombank was honored the VISA Awards 2022 with 9 items of important awards granted by VISA Inc at the Phu Quoc (Kien Giang province)

Awards received by Vietcombank including:

- Leadership in Payment Volume 2022

- Leadership in Cross-border eCommerce Payment Volume 2022

- Leadership in Commercial Payment Volume 2022

- Leadership in Domestic eCommerce Payment Volume 2022

- Leadership in Debit Payment Volume 2022

- Leadership in Credit Payment Volume 2022

- Leadership in Merchant Sales Volume 2022

- Leadership in eCommerce Merchant sales Volume Growth 2022

- Leadership in Acceptance Network Coverage 2022

These awards represent Vietcombank’s ceaseless efforts in investing, innovating and improving products and services, affirming customers’ trust on Vietcombank. At the awarding ceremony of Visa Awards 2022, Vietcombank took the most of awards in the banking industry.

11

THE BEST WORKPLACE IN BANKING INDUSTRY IN VIETNAM IN 7 CONSECUTIVE YEARS

Awarding body:

ANPHABE VÀ INTAGE

These awards represent Vietcombank’s ceaseless efforts in investing, innovating and improving products and services, affirming customers’ trust on Vietcombank.

November 2022, Anphabe Career Community and Intage Market Research Company announced the list of best workplaces in Vietnam in 2022. It is the 9th version of the award. Vietcombank continued to affirm its position as the most attractive workplace by 1st rank in the banking industry and 3rd in Vietnam market, top 50 most attractive employer brands. As the survey results, Vietcombank continued to maintain a leading position in the 7th consecutive year as the best workplace in the banking industry in Vietnam.

According to the survey results, Vietcombank to maintain a leading position in the 7th consecutive year as the best workplace in the banking industry in Vietnam.

12

Fitch Ratings affirmed Vietcombank’s credit rating

Awarding body:

FITCH RATINGS

On November 17th 2022, Fitch Ratings – credit rating agency announced the annual credit rating results 2022. Fitch Ratings upgraded Vietcombank’s credit rating to BB from BB- with positive outlook.

According to Fitch’s report, after years of rating support of Vietnam Government for commercial banks, Fitch affirmed Vietnam Government support rating is positive and ready to support banking system, especially moves of State Bank of Vietnam in the last two months. Therefore, Fitch has upgraded the Government’s support ratings for Vietcombank to BB from BB-. As a result, Vietcombank’s long-term Issuer default ratings are upgraded to BB with positive outcook.

Fitch also upgraded Vietcombank’s Viability Ratings (VR) to BB- thanked to stable liquidity, good asset quality, high non-performing loan ratio, with positive effects on its profitability.

The upgrade of Vietcombank’s credit ratings affirmed its efficient business performance in the past time and motivated Vietcombank to perform its business plan in 2022 and the coming years.

13

TOP 500 STRONGEST BANK IN ASIA PACIFIC

Awarding body:

THE ASIAN BANKER

The Asia Banker has recently announced the rankings of 500 strongest banks in Asia Pacific in 2022 by its balance sheet.

The ranking is based on criteria including total asset, capital adequacy ratio (CAR), loan balance, loan to deposit ratio (LDR), etc. Besides Asia Pacific,the ranking was expanded to other areas such as bankings in Middle East, Africa and Central Asia and Islamic banks worldwide.

CERTIFICATION BY FOREIGN BANKS

| Bank | Certification | |

|---|---|---|

|

Wells Fargo Bank, N.A. |

Excellent International Payment Quality Award |

|

J.P.Morgan Chase Bank, N.A. |

Excellent International Payment Quality for MT202 STP of 99.97% Award Excellent International Payment Quality for MT103 STP of 99.04% Award |

|

The Bank of New York Mellon |

Excellent International Payment Quality Award |

|

Citibank, N.A. |

Excellent International Payment Quality Award |

|

Standard Chartered Bank |

Excellent International Payment Quality in USD |

|

HSBC Bank Plc |

Excellent International Payment Quality in USD |

|

ANZ Group |

Excellent International Payment Quality in AUD |