PERFORMANCE REPORT

Results

Notable factors on production and business in 2021

Throughout 2021, the fertilizer market has seen the price of most products increase sharply, particularly the price of the Corporation’s leading product, Urea, which increased to its highest level ever;

Phu My brand has significantly increased in prestige with customers. The distribution system has been considerably deepened and widened in the regions where consumption occurs;

Production levels at the Phu My Fertilizer Plant are ensured at high capacity with a sufficient input supply of gas;

The sources of capital are guaranteed sufficiently and timely for production and business activities.

Although the input supply of gas is still guaranteed, the share of low-cost associated gas sources (Bach Ho - Rong Doi Moi field, Cuu Long Basin) was ultimately less than was projected and are dropping fast. The share of gas supplied from other sources (Nam Con Son and other Cuu Long) therefore increased at a higher than was projected, and the transportation costs were high, leading to a rising cost of gas;

The price of oil increased globally, raising the cost of input gas and freight overheads;

The Covid-19 pandemic situation is complicated; the supply chain has experienced significant interruptions, resulting in economic degradation; complying with pandemic prevention and control requirements in the company’s operations has increased PVFCCo’s associated costs;

Input costs for agriculture, particularly high fertilizer prices, have had a direct effect on farmers’ profitability, which has resulted in a tendency to limit crop fertilizer investments, which consequently impacts the Corporation’s overall production and business activities;

After 18 years of operation, the Phu My Fertilizer Plant’s machinery and equipment pose possible dangers, which has necessitated increased maintenance and repair expenses;

VAT policy has not been adjusted appropriately.

Outstanding results in production and business

The Phu My Fertilizer Plant has finished its production plan 12 days ahead of schedule, resulting in an annual output of 797 thousand tons of Phu My Urea, 4% higher than the yearly target. The production of NH3 for consumption reached 69 thousand tons – 9% more than planned. Phu My NPK output surpassed 162 thousand tons, exceeding the plan by 1% and achieving a 41% increase from 2020.

Effectively trading about 1.1 million tons of fertilizer (749,000 tons of Phu My Urea; 152,000 tons of Phu My NPK - the greatest volume of NPK ever traded; 244,000 tons of other fertilizer) and 124,000 tons of chemicals.

Revenue reached VND 13,117 billion, which was 109% of the plan, and an increase of 63% compared to 2020.

Profit before tax reached VND 3,799 billion, achieving 169% of the plan for the year and 348% higher YoY. Apart from the increased sales prices for our primary products, the high profit margin can also be attributed to the following:

- The Corporation has a suitable solution for operating the production and business, managing costs, optimizing the manufacturing process, improving product quality, and reducing raw material and energy consumption, thereby keeping product costs under control.

- Following the State Audit Office of Vietnam’s Announcement on audit results, the Corporation recorded a decrease in certain expenses and an increase in other income into its business results for the first six months of 2021, resulting in a profit increase of VND 269 billion.

Revenue

VND

13,117

billion

reached 109% of the plan, and an increase of 63% compared to 2020

Profit before tax

VND

3,799

billion

reached 169% of the plan, and an increase of 348% compared to 2020

Summary on business performance 2021

| No. | Item | Unit | Actual 2020 | Plan 2021 (adjusted) | Actual 2021 | Ratio compared with 2020 (%) | Plan completion rate (%) |

|---|---|---|---|---|---|---|---|

| A | B | C | 1 | 2 | 3 | 4=3/1 | 5=3/2 |

| 1 | Production | ||||||

| 1.1 | Phu My Urea | Thousand tons | 866 | 766 | 797 | 92% | 104% |

| 1.2 | UFC 85 | Thousand tons | 13.5 | 12.5 | 12.0 | 89% | 96% |

| 1.3 | NPK | Thousand tons | 115 | 160 | 162 | 141% | 101% |

| 1.4 | NH3 (for trading) | Thousand tons | 74 | 63 | 69 | 93% | 109% |

| 2 | Sales volume | ||||||

| 2.1 | Phu My Urea | Thousand tons | 827 | 750 | 749 | 91% | 100% |

| 2.2 | NPK | Thousand tons | 94 | 140 | 152 | 160% | 108% |

| 2.3 | Other fertilizers | Thousand tons | 179 | 280 | 244 | 136% | 87% |

| 2.4 | UFC 85 | Thousand tons | 9.6 | 8.5 | 9.4 | 98% | 111% |

| 2.5 | NH3 (for trading) | Thousand tons | 68 | 63 | 70 | 104% | 112% |

| 2.6 | CO2 | Thousand tons | 54 | 50 | 44 | 80% | 87% |

| 2.7 | Chemicals | Thousand tons | 0.7 | 0.6 | 0.8 | 112% | 116% |

| 3 | Consolidated financial indicators | ||||||

| 3.1 | Total revenue | VND billion | 8,038 | 12,000 | 13,117 | 163% | 109% |

| 3.2 | Profit before tax | VND billion | 848 | 2,251 | 3,799 | 448% | 169% |

| 3.3 | Profit after tax | VND billion | 702 | 1,890 | 3,172 | 452% | 168% |

| 3.4 | Budget payable (paid) | VND billion | 439 | 445 | 466 | 106% | 105% |

| 4 | Parent company’s financial indicators | ||||||

| 4.1 | Owner’s equity | VND billion | 8,127 | 7,584 | 10,503 | 129% | 138% |

| 4.2 | In which: Charter capital | VND billion | 3,914 | 3,914 | 3,914 | 100% | 100% |

| 4.3 | Total revenue | VND billion | 7,411 | 10,738 | 11,951 | 161% | 111% |

| 4.4 | Profit before tax | VND billion | 815 | 2,086 | 3,612 | 443% | 173% |

| 4.5 | Profit after tax | VND billion | 682 | 1,772 | 3,030 | 445% | 171% |

| 4.6 | Ratio of Profit after tax/Charter capital | % | 17% | 45% | 77% | 445% | 171% |

| 4.7 | Budget payable | % | 419 | 417 | 423 | 101% | 101% |

| 4.8 | Investment | ||||||

| 4.8.1 | Investment disbursement | VND billion | 75 | 263 | 110 | 147% | 42% |

| Capex | VND billion | 56 | 223 | 89 | 158% | 40% | |

| Equipment procurement | VND billion | 19 | 40 | 22 | 115% | 54% | |

| Capital investment | VND billion | - | - | - | - | - | |

| 4.8.2 | Capital investment source | VND billion | 75 | 263 | 110 | 147% | 42% |

| Owner’s equity | VND billion | 75 | 215 | 62 | 82% | 29% | |

| Loans and others | VND billion | - | 49 | 49 | - | 100% | |

Revenue structure in 2021

Profit structure in 2021

Production and outcome of key products

Production and sales of Phu My Urea

Unit: Thousand tons

| Product | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Urea Production | 807 | 802 | 856 | 822 | 850 | 817 | 818 | 799 | 816 | 708 | 866 | 797 |

| Urea Consumption | 806 | 752 | 908 | 835 | 843 | 835 | 823 | 794 | 812 | 691 | 827 | 749 |

| NPK Production | 58 | 85 | 118 | 162 | ||||||||

| NPK Consumption | 38 | 77 | 95 | 152 |

Production and sales of Phu My Urea in 2019 - 2021

Unit: Thousand tons

Consolidated financial indicators

Unit: VND billion

| Financial indicators | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 6,999 | 9,763 | 13,906 | 10,807 | 9,972 | 10,047 | 8,170 | 8,178 | 9,439 | 7,831 | 8,038 | 13,117 |

| Budget payable | 405 | 537 | 694 | 602 | 308 | 420 | 474 | 515 | 297 | 128 | 287 | 466 |

| Profit before tax | 1,922 | 3,510 | 3,542 | 2,468 | 1,285 | 1,880 | 1,393 | 853 | 871 | 467 | 848 | 3,799 |

| Profit after tax | 1,706 | 3,140 | 3,016 | 2,142 | 1,096 | 1,488 | 1,165 | 708 | 712 | 389 | 702 | 3,172 |

Consolidated financial indicators in 2019 - 2021

Unit: VND billion

The Corporation’s financial performance

Assets and capital

Unit: VND billion

| Item | 31/12/2020 | 31/12/2021 | % Increase (Decrease) |

|---|---|---|---|

| TOTAL ASSETS | 11,300 | 13,918 | 23% |

| Current assets | 6,314 | 9,520 | 51% |

| Non-current asset | 4,986 | 4,398 | -12% |

| TOTAL RESOURCES | 11,300 | 13,918 | 23% |

| LIABILITIES | 3,052 | 3,205 | 5% |

| OWNER’S EQUITY | 8,247 | 10,713 | 30% |

| Charter capital | 3,914 | 3,914 | |

| TOTAL REVENUE | 8,038 | 13,117 | 63% |

| TOTAL COST | 7,192 | 9,320 | 30% |

| INTEREST | 88.4 | 69.2 | -22% |

| EBIT | 934 | 3,866 | 314% |

| PROFIT BEFORE TAX | 848 | 3,799 | 348% |

| PROFIT AFTER TAX | 702 | 3,172 | 352% |

| Profit after tax of minority shareholders | 10 | 54 | 440% |

| Profit after tax of parent company | 692 | 3,117 | 350% |

Financial indicators

| Item | 2020 | 2021 |

|---|---|---|

| Liquidity ratios | ||

| Current ratio | 3.12 | 4.42 |

| Quick ratio | 2.39 | 3.13 |

| Solvency ratios | ||

| Total debt/total assets | 27% | 23% |

| Total debt/total equity | 37% | 30% |

| Operational capacity ratios | ||

| Inventory turnover | 4.28 | 3.77 |

| Net revenue/total assets | 0.68 | 1.01 |

| Profitability ratios | ||

| Net profit after tax/Net revenue | 9.04% | 24.80% |

| ROE | 8.55% | 33.45% |

| ROA | 6.17% | 25.15% |

| EPS | 1,413 | 7,749 |

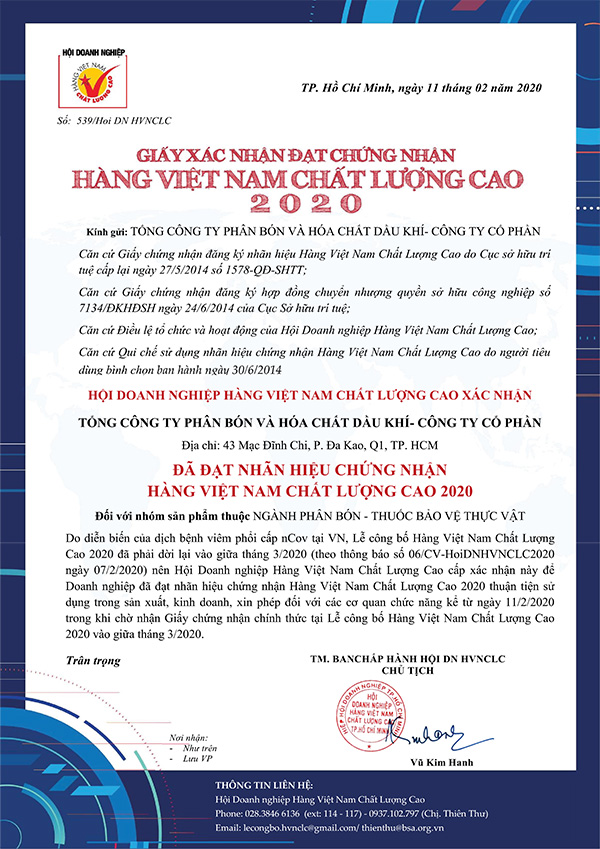

HONORS AND TITLES IN 2021

The National Brand

The title of High Quality Vietnamese Goods

Ranked among the Top 500 largest enterprises in Vietnam and

Top 500 most profitable companies in Vietnam

(Annual rankings by Vietnam Report)

Ranked among Top 50 competitively capable companies

(voted annually by VCCI)

2021 Ho Chi Minh City Golden Brand Award

(annual award by Ho Chi Minh City People’s Committees)

BOARD OF MANAGEMENT REPORT

Based on the actual situation, production and business conditions of 2021 as assessed, identified, and shown above, and on the duties and planned targets approved by the General Meeting of Shareholders, PVFCCo’s Board of Management has implemented timely, comprehensive, and flexible solutions to help the Corporation achieve production and business results of 2021, as detailed in the above report.

The Board of Management assesses the year’s progress as follows

- Total disbursement for investment and procurement projects is over VND 110 billion.

- Major investment project “NH3 Revamp - Phu My NPK Complex”: increasing the capacity of the NH3 production workshop at the Phu My Fertilizer Plant by 90,000 tons/year (around 20% increase compared to original capacity) and constructing a plant that uses NH3 originating from chemical technology to produce 250,000 tons of NPK per year have been effectively put into operation. In 2021, the Complex project continued to generate nearly VND 2,400 billion in revenue, accounting for roughly 18% of total revenue and VND 461 billion in profit, accounting for approximately 12% of the total profit of the Corporation.

The Remuneration Policy Improvement project and KPI project have provided motivation for employees to promote creativity and improvement in their work and assisted the Corporation in retaining highly skilled personnel.

Facing strict requirements of authorities on the prevention and control of Covid-19 pandemic, the Corporation has successfully and effectively implemented a series of countermeasures to ensure continuous and uninterrupted production and business operations: Planning for production, isolation, and accommodation in place, working from home at the Phu My Fertilizer Plant and Corporation headquarters; Organizing full and early vaccination for employees; Enhancing and transforming management and working systems through digital office and internet.

Financial analysis

Total assets as of 31/12/2021

VND

13,918

billion

an increase of 23% compared to the beginning of the year

Cash and cash equivalents

VND

2,524

billion

an increase of 24% compared to the beginning of the year

NH3 Revamp - Phu My NPK Complex generated in revenue

VND

2,400

billion

18% of total revenue

NH3 Revamp - Phu My NPK Complex generated in profit

VND

461

billion

12% of the total profit

Assets and Capital

Total assets as of 31/12/2021 was VND 13,918 billion, an increase of 23% compared to the beginning of the year (VND 13,918/11,300 billion). Cash and cash equivalents increased by 24% compared to the beginning of the year (VND 2,524/2,029 billion).

Liabilities:

- PVFCCo’s liabilities as of 31/12/2021 were VND 3,205 billion, up 5% compared to the beginning of the year (VND 3,205/3,052 billion).

- Total liability to total assets ratio and total liability to equity ratio decreased compared to those of 2020, but the current ratio and quick ratio in 2021 remained higher than 1. This demonstrates a good capacity to pay debts, and the Corporation is not under any pressure on due debt, ensuring good production and business activities.

- Given the closing balance of Cash and Cash equivalents of VND 2,524 billion, there is sufficient funding for manufacturing, trading and investment projects as planned.

Profitability

Profitability ratios of PVFCCo such as ROE, ROA increased sharply compared to those of 2020 (291% and 308%, respectively).

ASSESSMENTS OF THE BOARD OF DIRECTORS ON PVFCCo’S OPERATIONS

In accordance with the Enterprise Law 2020, PVFCCo applied a corporate governance model that includes a General Meeting of Shareholders, a Board of Supervisors, and a Board of Management. Corporate governance complied with and met the requirements of Decree No. 155/2021/NĐ-CP, dated 31/12/2020, issued by the Government. All internal operations, supervision, and auditing were covered by the corporate governance practices. The financial statements were prepared in accordance with the law, reflecting accurately and honestly the production and business activities of the Corporation, and they were audited by renowned external auditors approved by the Ministry of Finance. Members of the BOD, BOS, and BOM are capable and qualified, and their services are free of conflicts of interest. They have performed their roles and duties effectively, contributing to help the Corporation to fulfill its annual production and business plan. The Corporation is constantly working to improve its governance management, heading towards successfully applying upstanding practices such as: improving the BOD’s governance efficiency, improving the supervision of the BOS, implementing supportive solutions in management and administration of production and business: ERP, ISO, KPI management and performance evaluation systems, etc.

Urea’s export

60

thousand tons

NPK production

162

thousand tons

a sales volume of 152 thousand tons

Profit before tax

VND

3,799

billion

significantly exceeding the profit target set

The discussions from the two Annual General Meetings of Shareholders are summarized as Advantages and Limitations. The Corporation successfully achieved and exceeded its annual planned targets in production, and operations and financial performance.

Along with guaranteeing the optimal production and sales efficiency of the Corporation’s flagship product, Phu My Urea, the Corporation concentrated on cost and asset management in 2021, as well as boosting the operations of self-employed fertilizer distributors. The Corporation aggressively promoted the sale of its specialty Phu My fertilizer products (Phu My NPK, Phu My MOP), which contributed to the overall success outcomes while maximizing the distribution system’s efficiency. The distribution subsidiaries took the initiative to steadily increase their business’s competitiveness in fertilizers and oil and gas chemicals. The Corporation exported about 60,000 tons of Urea.

The Phu My Fertilizer Plant exceeded both the Urea and NPK production plan. In 2021, the NPK Plant produced 162 thousand tons of NPK with a sales volume of 152 thousand tons.

The Corporation has adopted an honesty and transparency policy. As an award-winning organization, the management adhered to these principles as a foundation and standard for best practices. In 2021, the Corporation maintained an effective integrated management system in accordance with ISO 9001 - 2008, OHSAS 18001 - 2007, and ISO 14001 - 2004; systems such as ERP, STOP, 5S, Six Sigma, CBM, RCA, FMEA, RBI, and RCM, and so on. The Corporation also developed a set of measures to determine the effectiveness of its key performance indicators and salary innovation projects (3P). The intention of this initiative is to foster a professional, fair, and efficient work environment. Internal auditing was deployed with a fresh strategy to complete and upgrade risk management in PVFCCo’s manufacturing and commercial operations.

With the aforementioned performance, the Corporation achieved a profit before tax of VND 3,799 billion, significantly exceeding the profit target set by the General Meeting of Shareholders.

The Corporation is committed to upholding the highest standards of environmental and social responsibility in all of its manufacturing, commercial, and investment activities. The Corporation’s primary activities are in the sector of fertilizer and chemical production, both of which are environmentally responsible and have a high potential for negative impact on the environment. Compliance with applicable safety and environmental laws is therefore a major emphasis during production. In product distribution, the Corporation is constantly developing programs and initiatives to educate farmers about the effective and economical use of fertilizers while reducing environmental impact.

The Corporation remains focused on its duties and obligations to society. It has consistently and actively contributed to social security work and cared for its employees throughout the years.

The results of the implementation of environmental and social responsibilities in 2021 are presented in detail in the Sustainable Development Report.

- The members of the Board of Management are all qualified, capable, and qualified, professionally trained, knowledgeable in their assigned fields, and have extensive experience managing and administering significant projects/enterprises.

- The President and CEO has delegated specific roles to the Vice Presidents and conducted weekly briefings to assess weekly work results and assign the work plan for the following term.

- The Board of Management conducted the unit’s business activities in accordance with the General Meeting of Shareholders’ resolutions, under the direction of the Board of Directors, and in strict compliance with the enterprise’s charter and legal provisions.

- The Board of Management maintained a comprehensive awareness of the Corporation’s advantages and disadvantages, which enabled it to adapt operating production and business activities while also issuing internal documents in accordance with its authority to effectively control the Corporation’s production and business activities; effectively performing the role of risk control beginning with the Board of Management and middle managers.

The Board of Directors’ plans and orientations for 2022

With the fertilizer market projection, gas prices will continue to be challenging in 2022, as they were in 2021. However, with the help of the fertilizer market, the Corporation has achieved remarkable profit results in 2021. The Board of Directors has established a business plan for 2022, with the cooperation of State shareholders specifically as follows:

Production targets

| No. | Item | Unit | Plan 2022 |

|---|---|---|---|

| I | Production output | ||

| 1 | Phu My Urea | Thousand tons | 828.0 |

| 2 | Phu My NPK | Thousand tons | 165.0 |

| 3 | Phu My Urea + KeBo | Thousand tons | 10.0 |

| 4 | UFC 85/Fomaldehyde | Thousand tons | 12.8 |

| 5 | NH3 (for trading) | Thousand tons | 70.0 |

| II | Sales volume | ||

| 1 | Phu My Urea | Thousand tons | 800.0 |

| 2 | Phu My NPK | Thousand tons | 165.0 |

| 3 | Phu My Urea + KeBo | Thousand tons | 10.0 |

| 4 | UFC 85/Fomaldehyde | Thousand tons | 8.5 |

| 5 | NH3 | Thousand tons | 70.0 |

| 6 | Other fertilizers | Thousand tons | 234.0 |

| 7 | CO2 | Thousand tons | 50.0 |

| 8 | Other chemicals | Thousand tons | 0.668 |

The Corporation’s financial plan (consolidated)

| No. | Item | Unit | Plan 2022 |

|---|---|---|---|

| 1 | Total revenue | VND billion | 11,059 |

| 2 | Profit before tax | VND billion | 1,130 |

| 3 | Profit after tax | VND billion | 945 |

| 4 | Budget payable | VND billion | 286 |

| 5 | Average labor productivity (by revenue) | VND million/person/month | 587 |

Parent company’s plan

Financial plan

| No. | Item | Unit | Plan 2022 |

|---|---|---|---|

| 1 | Owner’s equity | VND billion | 7,895 |

| 2 | Of which: Charter capital/average charter capital | VND billion | 3,914 |

| 3 | Total revenue | VND billion | 10,767 |

| 4 | Profit before tax | VND billion | 1,101 |

| 5 | Profit after tax | VND billion | 927 |

| 6 | Ratio of Profit after Tax/Average Owner’s equity | % | 11.7 |

| 7 | Ratio of Dividend/Charter capital (*) | % | 15.0 |

| 8 | Total debt/ Total owner’s equity | Times | 0.37 |

| 9 | Budget payable | VND billion | 267 |

(*) The dividend ratio is provisional based on assumed gas price for Phu My Urea production. Gas price/Gas transportation charges for Phu My Urea production in 2022, which will be regulated accurately after approval/acceptance by competent authorities.

Capital investment plan

| No. | Item | Unit | Plan 2022 |

|---|---|---|---|

| I | Total capital investment | VND billion | 252.6 |

| 1 | Capex | VND billion | 105.3 |

| 2 | Procurement projects | VND billion | 147.3 |

| 3 | Capital contribution to member companies | VND billion | - |

| II | Capital investment source | VND billion | 252.6 |

| 1 | Owner’s equity | VND billion | 252.6 |

| 2 | Loans and others | VND billion | - |

| III | Capital expenditure | VND billion | 252.6 |

| 1 | Owner’s equity | VND billion | 252.6 |

| 2 | Loans and others | VND billion | - |

scroll down