For urea, it is expected that fertilizer demand will recover in 2023 compared to that of 2022. The market mainly expects user demand to increase to compensate after a year of drastic reduction in all nutrients for plants; the possibility that the domestic market urea price will decrease due to the decrease in world urea price in 2023 will help people continue to increase investment in fertilizers to increase production productivity. However, it is likely that Vietnam’s fertilizer demand will remain lower than that of 2021. Specifically, AgroMonitor estimates that Vietnam’s fertilizer demand will increase by 10-18% compared to that of 2022 but will be about 8-13% lower than that of 2021. It is predicted that there is strong increase in DAP (28-46%), urea (12-16%), and MOP (15-26%); lower increase of other fertilizers is expected (7-14% for NPK, 7-11% for SA, etc.).

For NPK, AgroMonitor forecasts that in 2023, production and consumption will move in the same direction; recovery will be slow in the first half of the year and may be more positive in the last months of the year if the straight fertilizer pricing declines significantly. Regarding imports, in the beginning of 2023, it is forecast that there will be a return of Russian goods after imports being halted from July 2022 (importers have signed contracts to buy since the end of the year); However, the rumored price has not decreased significantly compared to that of the orders from mid-2022 and the amount of NPK imported from Russia is still subject to NPK export quota in the first half of 2023. NPK from China is rumored to increase owning to the possibility that China will gradually loosen its export policies in 2023.

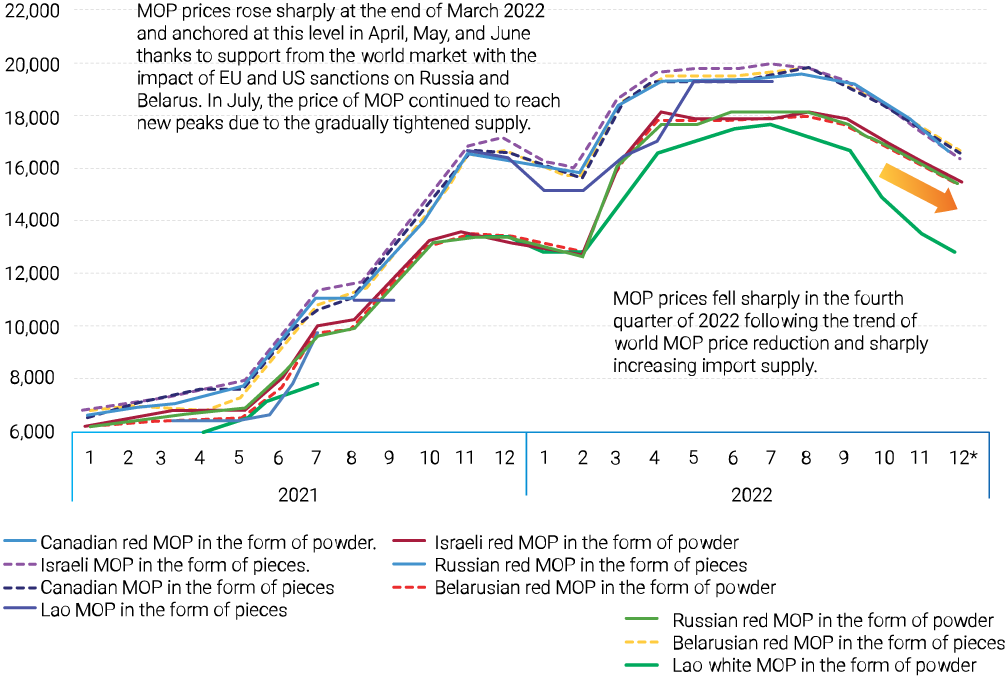

MOP supply in Vietnam depends on imports, so in 2023 it will continue to be affected by world supply and prices. ICI experts forecast that in 2023 the world supply of MOP may not be guaranteed because the sanctions against Belarus and Russia are still in place etc. Therefore, the MOP price may remain high. However, after consumption demand in Vietnam and the world both fell sharply in 2022, the market expects demand to recover in 2023 although it is difficult to return to 2021’s levels. AgroMonitor forecasts MOP consumption in Vietnam in 2023 will increase 24-35% compared to that of 2022 to 230,000-250,000 tons, but still reduced by 110,000-130,000 tons compared to 2021’s figures. Import volume is also forecasted to increase to 800,000-900,000 tons, an increase of 250,000-350,000 tons compared to 2022’s import volume but there will still be a decrease of 300,000-400,000 tons compared to 2021’s figures.

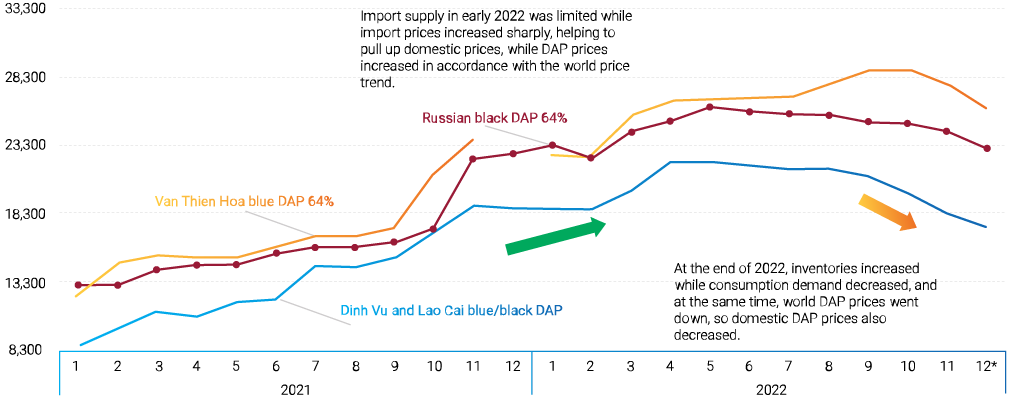

For DAP, in 2023 the import amount is expected to increase compared to 2022’s; however, the increase may be more obvious in the second half of 2023. AgroMonitor predicts that DAP imports in 2023 will increase to 350,000-400,000 tons, an increase of over 20% from 292,000 tons in 2022, and will return to the level of 2021, when China began to tighten its export activities due to the escalating DAP price because of the energy crisis. Domestic consumption of DAP (for crops and NPK production) in 2023 will increase to 570,000-650,000 tons, up from 445,000 tons in 2022, but still down from 770,000 tons in 2021. For domestic production, according to the production plan of DAP factories in 2023, output will increase again after a sharp decline in 2022. However, factories will monitor supply and demand and price trends to flexibly adjust production according to the actual direction. It is forecasted that the output in 2023 will reach 400,000-420,000 tons, an increase of 337,000 tons compared to that of 2022.