VISION, MISSION

CORE VALUES

Vision

To become one of the leading joint stock commercial banks in Vietnam, focusing on retail banking.

Mission

To provide Financial Solutions which are Effective, Fast and satisfactory to customers' demand.

Core Values

- Result Orientation

- Accountability

- Value – Added Creativity

- High touch

- Servant mindset customer service

OVERVIEW

Business name: AN BINH COMMERCIAL JOINT STOCK BANK

Abbreviation: ABBANK

Business registration: No.: 0301412222, amended for twenty-five time on the 22nd July 2019 by Department of Planning and Investment in Ho Chi Minh City

Charter capital

5,713,113,550,000 VND

Address: 1st, 2nd, 3rd Floor, Geleximco Building, No. 36 Hoang Cau Street, O Cho Dua Ward, Dong Da District, Hanoi

Telephone: (84-24) 37 612 888

Website: www.abbank.vn

Stock code: ABB

Key milestones

2020 major events

In 2020, the shares of ABBANK officially concentratedly traded on UPCoM in accordance with the requirements of the Prime Minister and the State Bank of Vietnam. In addition, ABBANK officially launched the ICAAP project, directing to comply with the requirement of Circular 13/2018/TT-NHNN of the State Bank of Vietnam.

Business Fields and

market area

Commercial bank-based operations are initiated by ABBANK in accordance with the regulations of the laws and SBV, including:

Regarding business location, at the end of 2020, ABBANK network system is extended up to 165 transaction points (35 branches and 130 transaction offices) in 34 provinces and cities, nationwide.

Chart of

165

TRANSACTION POINTS

Allocated

35

BRANCHES

by geographic area

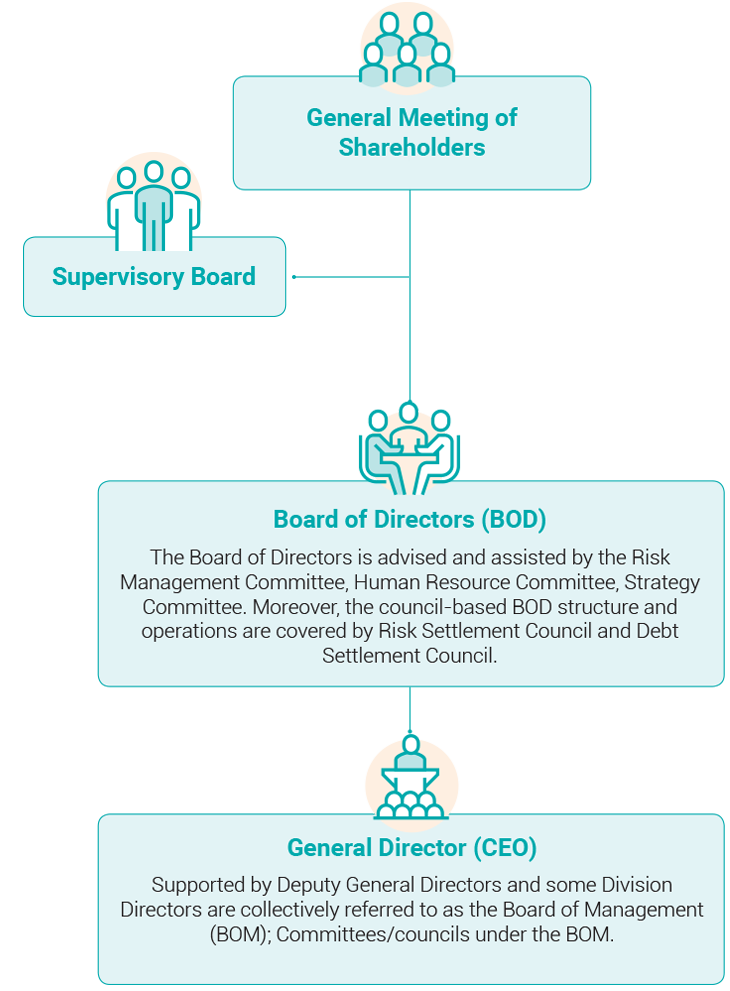

ORGANIZATIONAL structure

Governance model

According to the Charter of An Binh Commercial Joint Stock Bank (ABBANK). ABBANK is characterized by management organization structure under Joint Stock Company Model, concretely:

General Meeting of Shareholders

- The General Meeting of Shareholders comprising of all shareholders who are entitled to vote is assigned with the highest decision-making of ABBANK. The General Meeting of Shareholders has important rights and obligations such as: Approve the Bank’s development orientation; Approve the Bank’s Charter; Elect, remove and dismiss members of BOD and Supervisory Board; Ratify the annual financial statements and profit distribution plan upon completion of tax obligations and other financial obligations; Decide investment and sales of assets with value of 20% or more against the charter capital; Decide separation, division, merger, incorporation, legal form transformation, dissolution or bankruptcy, etc.

- Approve the decisions under its authority by voting at the meeting or written consultation form in accordance with the regulations of the laws and the Bank’s Charter.

- The Decision of the General Meeting of Shareholders approved at the meeting as voted by shareholders representing for over 51% of total voting shares of participants, unless 65% is required when decisions are approved such as: Change in charter capital; amendment to the Charter; Investment and sales of assets worth 20% of chartered capital or more; Bank reorganization and termination. The decisions of the General Meeting of Shareholders are approved by shareholder consultation by written circulation and ratified when consent is obtained from shareholders representing at least 71% of total voting shares.

Board of Directors (BOD)

Roles of BOD: BOD is the governance body, having sole rights to act on behalf of ABBANK to decide and fulfill the Bank’s rights and obligations, unless issues under the authority of the General Meeting of Shareholders.

Composition of the BOD: ABBANK BOD in term of 2018 - 2022 was elected on the 25th April 2018 by the General Meeting of Shareholders and additionally elected on the 12th June 2020. Currently, BOD comprises of 07 members. All BOD members are non-executive, including 02 independent members.

Non-executive member of BOD: (hereinafter referred to as non-executive member) refers to a BOD member not Director (General Director), Deputy Director (Deputy General Director), Chief Accountant and other executive officers under the Charter (according to Article 2 of the Decree No. 71/2017/NĐ-CP of the Government dated 6 June 2017 on corporate governance of public companies).

Board of Directors' Activities

Due to the complicated development of Covid-19 pandemics with foreign BOD members of 3/7 members, 02 onsite meeting sessions were held by ABBANK BOD. According to the issued Regulations on approving BOD decisions, the BOD exchanged viewpoints and voted via email to approve a series of internal policies and regulations.

Board of Directors' ASSESSMENT

Assessment and self-assessment are complied with the Regulation on Organization Structure and Operation of ABBANK BOD and legal regulations.

Sub-Committees under BOD

is established to advise and assist the BOD in developing, monitoring and supervising the fulfillment of ABBANK’s development strategy.

is established to help BOD to exercise its rights and obligations in deciding the risk management policies and monitoring fulfillment of the Bank’s risk controls (except for issues under the authority of the General Meeting of Shareholders).

is established to help BOD to exercise its rights and obligations in deciding the Bank’s governance policies and human resources structure (except for issues under the authority of the General Meeting of Shareholders).

is established with main functions, i.e., advise and decide the fulfillment of credit risk provision policy in accordance with the regulations of the Laws and ABBANK.

is established with main functions, i.e., advise and assist BOD in fulfilling debt settlement.

Subsidiaries, Associates

ABBANK ASSET MANAGEMENT ONE MEMBER COMPANY LIMITED (ABBA)

Address: 2nd Floor, Geleximco Building, No. 36 Hoang Cau Street, O Cho Dua Ward, Dong Da District, Hanoi

Relationship with ABBANK: Subsidiary

Actual contributed charter capital (VND million):

260,000

Ownership percent of ABBANK:100%

Read moreABBA SECURITY ONE MEMBER COMPANY LIMITED (ABBAS)

Address: 2nd Floor, Geleximco Building, No. 36 Hoang Cau Street, O Cho Dua Ward, Dong Da District, Hanoi

Relationship with ABBANK: ABBANK’s subsidiaries are indirectly invested via ABBA

Actual contributed charter capital (VND million):

2,000

Ownership percent of ABBANK’s: 100%

Read moreBusiness

Direction

Stable and sustainable growth objective, focusing on retail banking including individual customers and SMEs as ABBANK's long-term development orientation.

In order to successfully fulfill this objective, ABBANK focuses on investing into human resources, technology, customer services, development of effective risk controls and high awareness of renovating and improving both quality, services, modern infrastructure, etc. Any operations initiated by ABBANK aim to provide the best products and services to the customers’ highest satisfaction, ensuring rights and benefits of the shareholders, customers, society and employees of ABBANK.

In 2020, ABBANK continued to improve the business performance through 3 main objectives:

- Specialize and improve the sales capacity and performance of Business Units (BUs).

- Apply the comprehensive business administration, risk management and quality management.

- Exploit and optimize any resources, especially qualified resources from the Bank.

Nearly 25 strategic projects have been launched in the most recent years, covering the fields of business, products and services, technology, operation, risk management, business administration, etc., to successfully grow and transform ABBANK to reach professional, modern and sustainable development with practically good performance.

In 2020, the strategic projects were continued to be comprehensively perfected, newly initiated and connected with technology application projects such as LOS, BI/MIS, ALM, RWA, Data Governance, ICAAP, etc. The Projects put into operation offered positive efficiencies in ABBANK business and help ABBANK to comply with the Basel II requirements of the Government and SBV, the international practices and standards on advanced governance.

Particularly, ABBANK brand was remained to be positioned by The bank that furnishes all – in services and products for families, focusing on customer’s service experience by adjusting the new CIs with high applicability, modern and user-friendly features; technology application into products and services aimed to save time and provide added value to the customers.

Concurrently, the investment and tremendous enthusiasm were also reserved for the charity activities on education, human resources. Development of new rural facilities, covering the Northern-Central-Southern provinces, also facilitated the ABBANK brand identifiers and prestige as a modern, friendly and high CSR bank.

RISK MANAGEMENT

Tremendous focus on risk management solutions in the technology era 4.0

In 2020, ABBANK’s risk management policies were continued to be perfected. Accordingly, 3 hedging routes’ performance was improved and the Bank’s material risks were well controlled in any material aspects in accordance with the risk appetite promulgated by BOD. Some noteworthy achievements on risk management were obtained by ABBANK in the last year:

Basel deployment

Following the 2019 RWA project success, the ICAAP Project was continued to be booted at the end of Q1/2020. This was the second project within the Master Basel Project framework approved by BOD.

The BOD judged that the launch of the ICAAP Project does not only aim to comply with SBV’s relevant regulations but also offer the practical benefits to ABBANK’s business, concretely:

- Comply with requirements on internal adequate capital ratio assessment specified in Chapter V of the Circular No. 13/2018/TT-NHNN;

- Conduct the risk management capacity building through identification, assessment, measurement and capitalization for all material risks at ABBANK, improve the Risk Appetite;

- Associated between the risk management with the Bank’s business plan and capital plan, ensuring capital adequacy ratio and business performance based on risk assessment in all general business scenario and adverse scenario;

- Contribute to improving ABBANK prestige and position in the eyes of investors, independent rating agencies, SBV supervisor by enforcing the modern standards and practices on risk management;

- Facilitate to clarify the performance by measuring risk/benefit for each business division. Hence, improve the Bank’s profitability through recommendations and suggestions to the BOM and BOD before deciding on capital allocation, product development and structure, banking product and service pricing were made.

In order to concertize the above objectives, ICAAP project was launched into 2 phases as follows:

Phase

Develop the entire methodology framework on ICAAP deployment, including regulations on internal capital adequacy ratio assessment, regulations on the stress test, regulations on capital management and relevant reports and tools.

Phase

Deploy and apply the methodologies to be designed in the Bank’s daily operations.

At the end of 2020, ABBANK perfected the methodology framework, tools as well as seminars and internal training courses, including ICAAP related high-level seminars for participants as members BOD, BOM.

Download Chapter 1

Download Chapter 1